Beneficial

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

Count on us as your innovative direct lender. We guarantee data privacy and offer help when you need it most

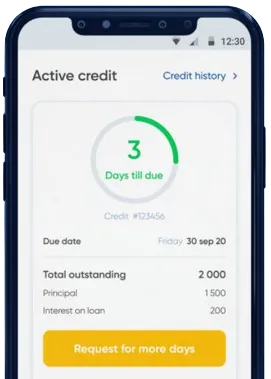

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Use the app to send your request, simply fill in the form.

Await approval. Decisions are typically made within 15 minutes.

Secure your funds, generally processed in just one minute.

Use the app to send your request, simply fill in the form.

Download loan app

Personal loans in Nigeria provide individuals with the opportunity to access funds quickly and easily for various financial needs. Whether you need to cover unexpected expenses, finance a home renovation, or consolidate debt, personal loans offer a flexible and convenient solution.

One of the key benefits of personal loans is their quick approval process. In Nigeria, many lenders offer same-day approval, allowing borrowers to access funds in as little as 24 hours. This can be invaluable in emergency situations or when you need funds urgently.

Personal loans in Nigeria offer flexible repayment terms, allowing borrowers to choose a repayment plan that suits their budget and financial goals. Whether you prefer weekly, bi-weekly, or monthly payments, you can find a lender that offers a repayment schedule that works for you.

Unlike traditional loans, personal loans in Nigeria do not require any collateral. This means that you can access funds based on your creditworthiness and income, without having to put up your assets as security. This makes personal loans a suitable option for individuals who do not have valuable assets to pledge as collateral.

By responsibly managing a personal loan in Nigeria, you can improve your credit score over time. Making timely payments and keeping your credit utilization ratio low can have a positive impact on your credit history, making it easier for you to access other forms of credit in the future.

Personal loans in Nigeria offer a range of benefits, from quick access to funds and flexible repayment options to the opportunity to improve your credit score. Whether you need cash for an emergency expense or want to consolidate debt, personal loans can be a useful tool to help you achieve your financial goals.

A personal loan is a type of loan that is borrowed from a financial institution, such as a bank, to be used for personal expenses such as home renovations, medical bills, or a vacation.

Typically, the requirements for obtaining a personal loan in Nigeria include a valid form of identification, proof of income, proof of employment, and a good credit score.

The maximum amount that can be borrowed through a personal loan in Nigeria depends on the financial institution and the borrower's creditworthiness. Typically, amounts can range from ₦50,000 to ₦10,000,000 or more.

The interest rate for personal loans in Nigeria varies depending on the financial institution, the loan amount, the loan term, and the borrower's credit score. Interest rates can range from 5% to 30% or more.

The repayment period for personal loans in Nigeria typically ranges from 6 months to 5 years, depending on the financial institution and the loan agreement. Some lenders may offer flexible repayment terms.

Yes, most financial institutions in Nigeria charge penalties for late payments on personal loans. These penalties can include additional fees, increased interest rates, and negative impacts on the borrower's credit score.